An unadjusted trial balance is the third phase of the accounting cycle. It is a chart comprising a list of a business account that has to appear on the financial statements before the current year. The primary purpose of preparing an unadjusted trial balance is to understand the transactions made during the year and to get the information from journal entries to find out any mistakes. It aids in the analyzation of a company or person’s individual account.

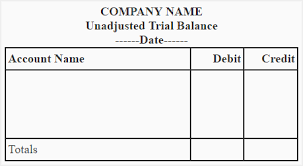

Unadjusted Trial Balance (UTB) Format:

The format of the unadjusted trial balance consists of three-columns, and the same can be created on a sheet of paper or any spreadsheet program. First, you need to add the period date above the table.

The first column will consist of the account name of the general ledgers that too followed by the debit, which indicates the remaining debt balance.

The last column is for credit. It will indicate the credit transaction followed by the listing of account names in general ledgers.

After that, the proper recording of journal entries in the trial balance should indicate the debit and credit amount the same. If there is any mismatch between debit and credit account, then there is a need to re-analyze the transactions of journal ledgers.

Format of Unadjusted Trial balance helps to prepare a balance sheet with correct assets, liabilities creation.

Example: XYZ Ltd

| Account Name | Debit | Credit |

| Cash | 20430 | |

| Accounts receivable | 5900 | |

| Office supplies | 22800 | |

| Prepaid rent | 36000 | |

| Equipment | 80000 | |

| Accounts payable | 30000 | |

| Notes payable | 20000 | |

| Utilities payable | 25000 | |

| Unearned revenue | 35000 | |

| Common stock | 90000 | |

| Service revenue | 15764 | |

| Wages expense | 38200 | |

| Miscellaneous Expense | 3470 | |

| Electricity expense | 2470 | |

| Telephone expense | 1494 | |

| Dividends | 5000 | |

| Totals | 215,764 | 215,764 |

This is the example of preparing the UTB format. We showed the example of XYZ company and the transactions they made during a financial year.

Purpose:

The primary purpose of preparing an unadjusted trial balance is to confirm, is there any differences in the balance of debits and credit. The proper recording of all transactions debit and credits indulged in getting the same trial balance at the end.

It also helps us to understand the errors we made during the preparation of the UTB and to ensure that there should be not any mistake while preparing the adjusted trial balance at the end.

However, there are some errors that can not be analyzed by the unadjusted trial balance. The errors are incorrect record and analyzation of transactions, the omission of accounts from the journal or ledger accounts.

Conclusion:

We know that an unadjusted trial balance is the third phase of the accounting cycle, and before that, we need to cover up the books of journal entries and ledgers to understand the transactions made during a year. The same has to analyze again with the UTB sheet to ensure that there should be not any misplaced information, and the debit amount should be equal to the credit amount.