There are lots of formulas as well as calculations when it comes to business accounting. Even they can be a little complex, but at the same time, they are extremely useful. Because of the formulas and calculations, you get a better insight into your business as well as finance. Accounts receivable turnover ratio is belonging to one of those formulas which help in determining the effectiveness of the business at debts collecting and exceeding credits from the customers.

Accounts Receivable Turnover: Definition and Ratio

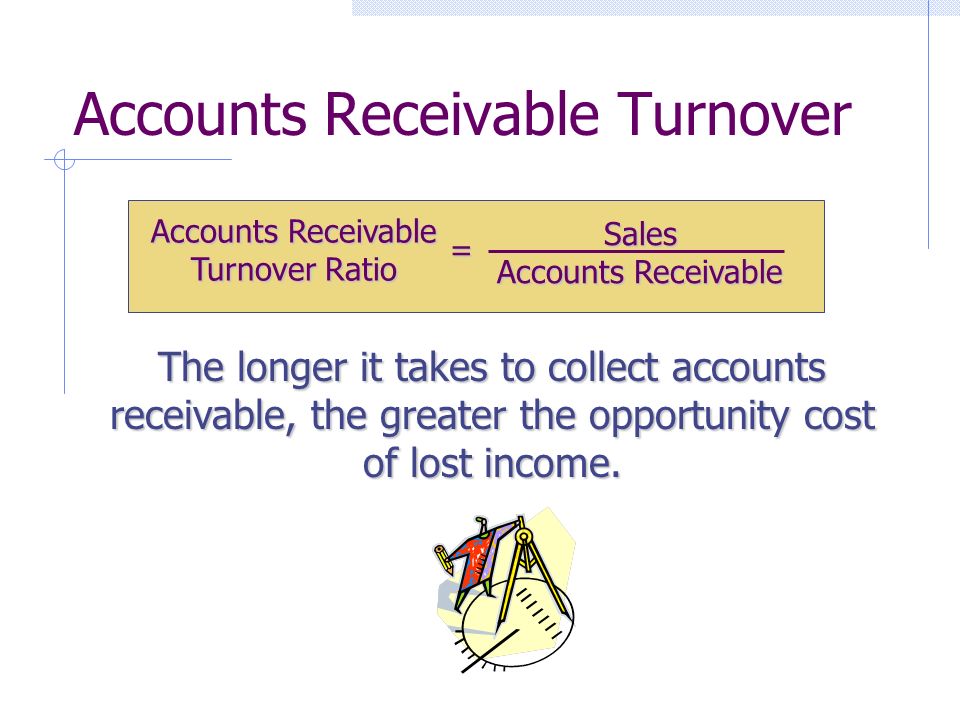

Well, the ratio is highly used and recommended in order to get information about the company’s cash flow or to get a loan and also to do better financial planning of your business. Accounts receivable turnover is the calculation related to accounting that used in measuring the business efficiency on how well they can collect payments and use their customer credit. Well, the ratio is basically measured on the annual basis where the formula of accounts receivable turnover ratio is used. For that, you are going to need two things i.e., average accounts receivable and net credit sales.

The formula: How to do it?

To calculate the accounts, receive turnover, you have to use the formula. However, before that, you need to understand the basics to get simple and hassles free calculation. Here is the formula which is used for accounts receive turnover ratio:

Receive turnover ratio: Net credit sales / Average Accounts Receivable

How you can calculate it:

Get the net credit sales of your business

The first accounting receivable turnover requires net credit sales. It also means whatever sales your company had made that year on credit or cash. This figure also needs to get include in the today credit sales. However, any kind of allowances or returns will get minus from the total. Also, you might get the net credit sales or annual income statement on the business’s balance sheet.

Get the average accounts receivable

After you get the net credit sales, the next thing you are going to need is average accounts receivable. This is also meaning the amount which is owed to you by the customers. To get the number, you are going to need the account receivable at the years beginning. Next, add to the amount you have at the end of that year. This total amount will get divided by two by which you get the average. However, you can also find the numbers on the business sheet as well.

Divide it

After you get both values, you can now use the formula. For the results, you have to divide the net credit sales and average accounts receivable. This will get you the account receivable turnover ratio as well as rate. However, this will not include the cash, and that’s why you won’t get the receivables. Well if the ratio you get is lower than it means you have lower payment collections from the customers. And in case of high numbers, you have higher payment collections from the customers.