There are lots of companies who use the financial metrics. It also includes the contribution margin, which helps in making the decision to keep or to discontinue the services and products in selling. With the help of this, the company can find out if their current selling profit or service is covering up all expenses and profiting at the same time. If not, then the product or services should be getting stop selling.

Contribution Margin: Formula and Calculation

Well, the companies look out for minimum price when it comes to selling the product so it can cover the basics as well, including the fixed expenses too. However, the increase or decrease in fixed expenses doesn’t vary in production. It includes property taxes, building rent, business insurance etc. It includes those expense that the company pays whether the production takes place for any sale. This is called break even analysis.

Well, contributing margin is an important part of even analysis; it is also known as dollar contribution upper unit. This is left money after the company pays after the sales, including all variables expenses.

How to Calculate: Its Formula

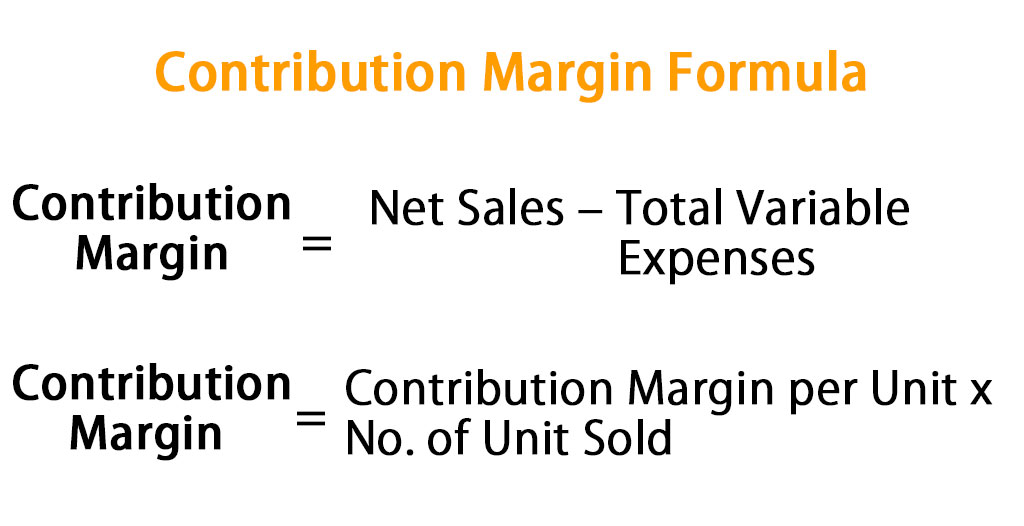

To calculate the contribution margin is easy; however, it’s important to understand how to do it. Here is the formula which can be applied to get the easy solution

Product revenue generated -product variable costs/product revenue generated

If you use it as an example, then, for instance, the company generates $250,000 from its product sales, where the $100,000 is the associated variable cost, then to calculate the contribution margin here is what you need to do

Contribution margin = 250,000-100,000/250.000

Well the contribution margin of the company will be .60 or 60%

Contribution Margin Ratio: what to know about good contribution margin?

Contribution margin ratio is used for finding the difference between sales and variable expense of the company. This is expressed in percentage. Also, the contribution margin needs to be higher in order to cover the administrative overhead as well as the fixed expenses. It helps in understand to determine to allow the lower price in the special situation in pricing.

The higher the contribution margin is, the better the results will be for the company. The higher ratio means the company is more efficient to cover up the overhead business expenses. The margin can be calculated to get the measure of profits that the company is getting from a particular product line.

How can the contribution margin improve?

Well, to improve the margin, either the company is going to need a reduction in variable cost, which includes shipping expenses and raw materials. If not, then the company is going to need to increase the price of their services or products. If the company’s contribution margin is going down, then it will be harder to cover the fixed costs. To improve the financial position, there are more ways, including the cutting cost such as eliminating non-essential positions and relocation to some less expensive area.