In today’s digital age, teaching kids about finance early on is crucial, and the right tools can make this educational journey both fun and effective. The top 5 finance apps for kids in 2024 are designed with this goal in mind, offering a mix of savings, investment opportunities, and earning through chores. Each app is tailored to engage children in different aspects of financial literacy, from managing savings accounts with attractive interest rates to learning about investing and the value of money through practical tasks.

These following 5 finance apps for kids are designed to spark meaningful conversations about money in your family. They highlight the importance of having an emergency fund for unforeseen circumstances. Through interactive and engaging tools, these apps stand out as expert recommendations for fostering financial literacy from a young age.

1. Rooster Money

Rooster Money is a popular app that helps kids learn about money management. It allows parents to create reward charts, set financial goals, schedule allowances, and track spending visually. The app categorizes money into Spend, Save, Gift, and Goals, and offers a Rooster Card for additional banking features. While the basic functions are free, a Rooster Plus subscription unlocks premium features like task management, without making the free version feel limited.

What does it cost?

Rooster Money offers a free Virtual Tracker perfect for families starting with basic pocket money routines or star charts. -month free trial available for the Rooster Card subscription.For those ready for more features, the Rooster Card is available at £1.99 per month or £19.99 per year.

2. GoHenry

GoHenry is a well-regarded personal finance app designed for minors, which stands out for its real-time money management capabilities with a prepaid debit card on both Google Play and the App Store. The setup process is quick and user-friendly, allowing parents to establish an account in less than five minutes. This account is then connected to individual accounts for each child, who receive a personal prepaid debit card. Through the app, parents can assign tasks, set spending limits, and receive notifications about their child’s purchases, providing a comprehensive and straightforward way to manage their finances.

What does it cost?

GoHenry offers a 1-month free trial, followed by a subscription cost of $4.99 per child per month. The plan includes a debit card for kids and a comprehensive app for parents, featuring tools for financial learning without transaction fees. Families can add up to four child accounts for $9.98 per month, with the option to cancel anytime.

3. iAllowance

iAllowance is a finance management app for iOS. It enables parents to manage their children’s allowances, assign chores, and reward them with money or alternative currencies like stars or “time bank” credits. Children can track their earnings, savings, and spending, encouraging financial responsibility. The app also allows for setting interest rates on savings, teaching the importance of compounding returns and long-term financial planning.

What does it cost?

The iAllowance app costs €2.99. It’s designed for iOS users, providing tools for managing children’s allowances, assigning chores, and tracking financial activities to teach them about saving and spending responsibly.

4. Revolut Under 18

The Revolut Under 18 account and card aim to teach money management to kids aged 6-17. Parents sign up for Revolut, create a <18 account for their child, and order a personalized card. Kids use the Junior app to check balances, view transactions, and get low balance alerts. Parents can oversee the account, set spending limits, restrict certain purchases, and adjust allowance amounts, offering a practical and educational tool for financial literacy.

What does it cost?

Revolut Under 18 accounts come with no monthly fees for the standard plan. However, there may be costs associated with ordering a physical, personalized bank card, such as shipping fees, depending on your location.

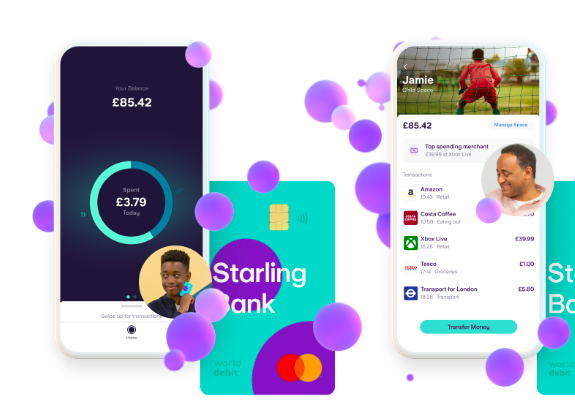

5. Starling Kite

Starling Kite is a child-friendly debit card for 6-16 year-olds, designed to simplify pocket money management, saving, and budgeting. It offers a simplified Starling app version for children to monitor their finances, featuring real-time spending notifications. Parental controls allow for setting spending limits, ensuring a balanced approach to financial independence and security.

What does it cost?

Starling Kite doesn’t have a monthly subscription fee. Additionally, it comes without fees for overseas transactions, payments, cash withdrawals, or topping up, making it a cost-effective option for managing children’s pocket money and spending.

Read more

Conclusion

To effectively teach kids about money, start by explaining where money comes from and guiding them to budget their allowance. Encourage them to be financially independent by giving them a set allowance and teach the value of setting and working towards goals. Always listen to their perspectives and offer advice respectfully, reinforcing positive financial behaviors.