Personal finance bloggers in India are crucial in educating the public about finance, making complex topics accessible and understandable. Their importance has grown with India’s digital revolution and the increasing desire for financial independence, especially as the economy evolves rapidly in 2024.

The rise of personal finance blogging in India reflects a shift towards entrepreneurship and the recognition of blogging as a viable profession, fueled by a growing interest in financial education and a diverse array of bloggers providing unique insights.

A curated list of the top 10 finance blogs in India offers diverse insights into managing finances, investment strategies, and personal finance tips, catering to various aspects of finance for education and growth.

1. Jagoinvestor

Jagoinvestor is a prominent platform founded in 2008 by Manish Chauhan and Nandish Desai, dedicated to offering online financial planning, investment advice, and wealth management services. It covers a wide range of topics such as family trusts, macroeconomics, fractional real estate, and FIRE, aiming to enhance the financial well-being of investors through education. Besides writing insightful articles, the founders also engage in conducting workshops across Indian cities and authoring personal finance books. Catering to clients both in India and overseas (NRIs), Jagoinvestor operates out of Pune and Ahmedabad, focusing on improving investors’ financial literacy and lives.

2. Safal Niveshak

Safal Niveshak, translating to ‘successful investor’ in Hindi, is a platform founded by Vishal Khandelwal in 2011. With over 19 years of experience in stock market investing and 11 years as an investment coach, Khandelwal’s initiative aims to educate individuals on value investing and behavioral finance for improved investment decisions. Offering online courses like the Financial Statement Analysis and Valuations Course and the Mastermind Value Investing Course, Safal Niveshak also provides a free newsletter, The Journal of Investing Wisdom, reaching over 90,000 subscribers globally, making it one of the most popular investment newsletters available.

3. BasuNivesh

BasuNivesh, established in 2011 by Basavaraj Tonagatti, is dedicated to spreading financial planning awareness. Tonagatti, a Certified Financial Planner and SEBI-registered Investment Advisor, has penned over 700 articles on personal finance. Operating on a fixed fee model, he has built a subscriber base of 10,000, providing guidance on investments, insurance, and mutual funds through his insightful blog posts. His goal is to educate and empower individuals in managing their finances effectively

4. Chartered Club

Chartered Club, founded by CA Karan Batra in 2009, is a personal finance website tailored for professionals seeking financial planning insights. In addition to publishing personal finance blogs, Chartered Club offers tax filing and advisory services, positioning itself as a comprehensive resource for financial and tax-related guidance. The platform aims to educate and assist professionals in managing their finances and tax obligations efficiently.

5. ReLakhs

ReLakhs.com stands out as a unique personal finance blog in India, notable for its commitment to providing valuable information without selling any products or services. Founded by Sreekanth, a Certified Financial Planner (CFP), this platform reflects the highest standards of education, examination, experience, and ethics as set by the Financial Planning Standards Board India. This qualification is widely recognized and respected globally within the financial community. Sreekanth, who also holds a Post Graduation Diploma in Business Administration from ICFAI Business School, offers a wealth of informative blogs on topics such as financial planning, real estate, and tax planning, aiming to educate readers on various aspects of personal finance.

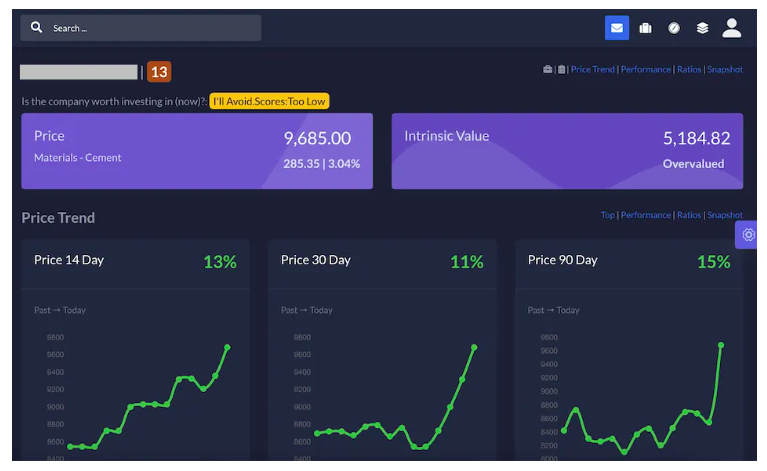

6. GetMoneyRich

Mr. Manish Choudhary, the mechanical engineering graduate behind GetMoneyRich, transitioned from a 16+-year corporate career to pursue financial independence through full-time blogging. His passion for empowering others in their financial journey led to the creation of the Stock Engine, a stock analysis tool designed to screen stocks with ratings based on the “Overall Score” and “GMR Score,” along with estimating the “Intrinsic Value” using multiple valuation models. Besides developing tools for financial analysis, he has also authored e-books, now offline, contributing further to his readers’ financial literacy and investment strategies.

7. Stable Investor

Stable Investor, founded in 2011 by SEBI registered investment advisor Dev Ashish, emphasizes long-term wealth creation through investing and personal financial planning. Operating on a fee-only structure, Dev Ashish brings his expertise to a range of investment products, including mutual funds and stock markets, with the goal of guiding individuals towards effective financial strategies and sustainable wealth building.

8. Taxguru

Taxguru, founded by Sandeep Kanoi, is a personal finance blog that delves into the world of taxation, offering in-depth knowledge and insights. It covers all types of taxes and personal finance topics, aiming to keep its readers informed with the latest information on notifications, amendments, and circulars related to finance. Taxguru is a valuable resource for anyone looking to stay updated on tax laws and personal finance management strategies.

9. Money Excel

Money Excel, owned and managed by Shitanshu Kapadia, is a personal finance blog that focuses on a wide array of financial topics. Kapadia’s expertise extends to financial planning, insurance, personal finance, investment, real estate, and the stock market, along with various other financial products. The blog aims to provide valuable insights and advice to help individuals make informed decisions about their finances and investments

10. Moneymint

Moneymint, founded by seasoned small business expert Aditya, is designed as a comprehensive resource for exploring diverse ways to earn money. Emphasizing the simplification and enjoyment of financial learning, Moneymint aims to make the complexities of money management accessible to everyone. With his extensive experience in entrepreneurship, Aditya brings valuable insights into the challenges and opportunities of running a successful small business, making Moneymint an essential destination for those looking to enhance their financial understanding and discover new avenues for income.

Read more

Conclusion

The best personal finance blogs in India offer a wealth of knowledge, guiding individuals through the complexities of financial management. Led by experts in the field, these blogs cover everything from investment strategies and savings tips to financial planning and beyond. They are invaluable resources for anyone aiming to improve their financial literacy and achieve financial independence in India’s dynamic economic landscape.