Kotak Mahindra Bank offers an option in their savings accounts to their customers that suit their individual needs. They have the savings account from premium to ordinary or basic accounts, from online bank accounts as well as account offline. Kotak Mahindra Bank offers various computerized ways for you to get to their services regarding their banking.

Well, net banking and mobile banking, both are the facilities that you get. Well, with these facilities you can access your account details, statements, transfer funds, etc. easily with simple clicks and process. You can activate the facilities by requesting and following some steps. Check Kotak 811 Internet and Mobile Banking Login steps below.

What are the Benefits of Kotak 811 Saving Account?

Kotak bank 811 is one of the most convenient options for those who don’t want to face the hassle of going to the bank and doing everything. It can be easily operated with the phone and also by sampling following some basic steps as well as guidelines. Apart from this, here are a few points that can help you in understanding Kotak 811 saving account benefits.

- Get a saving account open in a matter of moments with Kotak 811. Simply fill in the asked details and experience mobile banking more than ever

- You can also enjoy the advantage of Zero Balance Savings Account.

- Not just that the bank also provides up to 6% p.a. on your savings in your account which is currently available.

- You can also complete KYC by requesting a home visit and also to personal verifications. However, you just need to use your mobile banking app.

- You can do the Transfer reserves by means of IMPS/NEFT/RTGS.

- you also get your complimentary Virtual Debit Card with Kotak 811.

- Make installments without the issue of money and change. You can simply Pay for your shopping, taxi, staple goods, home conveyance and considerably more utilizing Kotak 811.

How to Open a Kotak 811 Bank Account Online?

You can quickly open a Kotak 811 bank account online with the help of your aadhar card, pan card, and registered mobile number. Furthermore, one can follow the steps that we have added below.

- First, one needs to download Kotak 811 mobile banking application from the respective app store.

- Once downloaded, open the application on your smartphone.

- You now have to click on the “Open a new 811 account” button.

- A form will appear on your smartphone screen.

- You now have to enter the aadhar card, pan card number.

- Enter all the personal details.

- You now have complete e-KYC verification. You can complete this by entering OTP you will receive on your mobile number. (However, make sure the mobile number is linked with your aadhar card)

- Once the e-KYC completes, you will get complete account information including the account number and virtual debit card.

- You now have to complete full verification by opting for a FULL KYC option from the application.

- An agent will visit the home for completing your verification.

- That’s it.

Kotak 811 Net Banking

Presently with Net Banking, you can get a helpful method so you can access your account from the solace of your home or office. The bank offers the one-stop answer for all your banking related needs 24×7 with services by Kotak Net Banking. Apart from that, Kotak Mahindra Bank uses the latest technology encryption, which helps in verifying the date moved to utilize their application.

Also, the information from your mobile server didn’t get saves so it can protect the transactions and everything related to your banking experience.

- Transfer reserves online between the third party with Kotak Mahindra Bank, or some other financial balance by means of NEFT, RTGS, or IMPS

- You can Book a Fixed or Recurring Deposit and make an untimely withdrawal on the web.

- Also, you can view and update your details on your Profile, for example, your mobile number, email ID, PAN Card, Aadhaar Number, FATCA Declaration, etc. immediately.

- View record balance, account action, and check status

- Pay your Utility Bills, Credit Card, Recharge prepaid versatile or DTH utilizing Kotak BillPay.

- Recharge prepaid cell phone and DTH accounts

- Book Air, Rail, Bus tickets and do Hotel appointments on the web

- Re-create Debit Card PIN, Activate and Deactivate Debit Card, Activate or Deactivate Debit Card for International Usage, Link Accounts

- Apply for New Debit Card, Upgrade Debit Card, Apply for Image Debit Card, etc

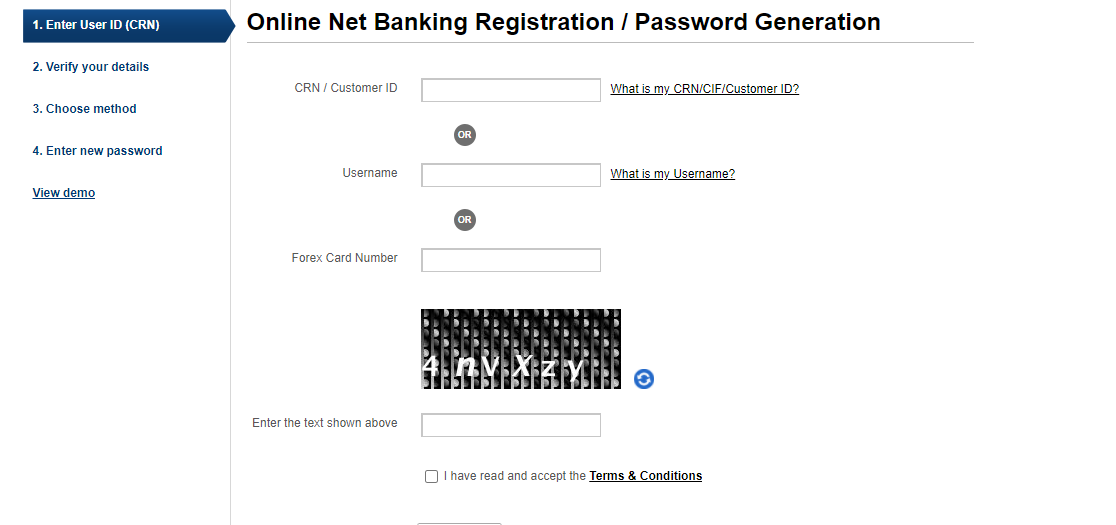

How to Register for Kotak 811 Internet Banking?

You can register for Kotak internet banking services online by following the steps given below.

- First, one needs to visit the internet banking website.

- After that, click on the new registration option.

- A registration form will now appear on the screen.

- You now have to enter the CRN number, and other required details.

- Complete the verification. (You can do this by providing debit card details and a one-time password)

- That’s it.

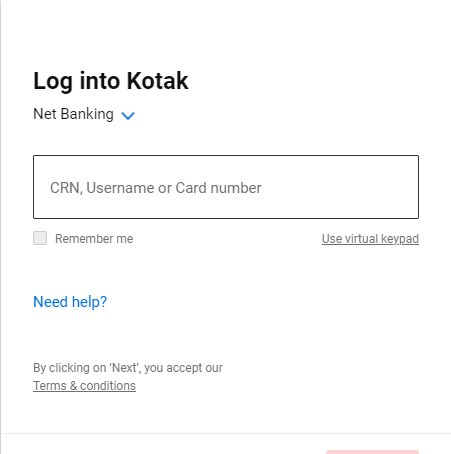

How to Login into Kotak 811 Net Banking?

Once the registration gets done, the customer can now login to the Kotak internet banking portal. Furthermore, one can follow the steps given below for getting logged in to the portal.

- First, one needs to visit the internet banking website.

- After that, one needs to click on the login option.

- The customer now needs to enter the CRN number and login password.

- Click on the login button.

- Accept the terms and conditions.

- Within a few seconds, one will get redirected to the Kotak internet banking dashboard.

How to Reset Net Banking Password?

- First, one needs to visit the internet banking website.

- After that, one needs to click on the login option.

- You now have to click on the “Forgot password” option.

- On the next screen, enter the CRN number along with other required details.

- Complete the verification. (You can do this by providing debit card details and a one-time password)

- After that, you can set up the new login password.

- That’s it.

What to know about mobile banking by the Kotak 811?

Here are points that can help you in understanding the mobile banking benefits of Kotak Mahindra bank that you can consider

- Mobile banking offered by Kotak Mahindra Bank is advantageous and spares time

- Mobile banking keeps the clients refreshed about their records all the time, which maintains a strategic distance from extortion.

- Kotak Mahindra’s versatile financial office is free of expense.

- Mobile banking alerts you of any bills that should be paid and therefore guarantees that they take care of every one of their tabs expeditiously.

- Kotak Mahindra versatile banking application enables the client to move reserves in a split second.

- Mobile banking is secure as it uses encoded innovation to keep transactions safe.

Register for Kotak Mahindra Mobile Banking

If you want to request services, it is crucial to enlist your mobile number with the bank. Ensure that the number you will use for banking is equivalent to the one you gave to the bank when making a record with Kotak Mahindra.

In any case, if you have changed your number, you can update the equivalent by visiting the bank or by utilizing their ATM. You can likewise refresh or enlist your number by utilizing Kotak Mahindra’s net banking. When the number is updated, here are the steps that you need to follow:

- Download Kotak Mahindra’s application for mobile banking from their application store.

- Launch the application and enter Customer Relation Number (CRN), you will locate this number on your card’s debit or credit.

- After entering the CRN, you can either go with your numbers of the credit or debit card or your details regarding the net banking to confirm the record.

- Next, you will be required to set a 6-digit MPIN

- After setting the MPIN, a confirmation code will be sent to the mobile number.

- Enter the code so you can process it.

Step by step instructions to log in to Kotak Mahindra Mobile Banking App

You can easily log into the mobile banking app, once your success gets registered, here are steps for you:

- Download the application from the application store.

- Launch the application and choose ‘Login.’

- You will be coordinated to another screen where you will be approached to enter the CRN.

- You can also avoid the login procedure by tapping on ‘Skip Login’ to see the services given.

- Alternatively, you can enter your CRN.

- If you are a first-time, you should experience the verification procedure by entering your details regarding the debit and credit card, or you can use your net banking details as well.

- Once you log in, you can proceed with a User ID and MPIN

How to Reset Kotak Mobile Banking MPIN?

- First, open the Kotak 811 mobile application on the smartphone.

- You now have to enter the CRN number.

- You will get an option to reset your MPIN. Just click on it.

- You now have to provide complete details of the debit card and complete the verification using the one-time password.

- Once it gets done, you can now set up the new login MPIN.

- That’s it.

Conclusion:

Kotak 811 was the new initiative from the Kotak Mahindra bank. It was after the demonetization and on 11/08/2016. This is the reason to name it Kotak 811. After that onwards, the digital India process was started. Kotak 811 allows the customers to open their full established bank account with them at ease. They only need to download the application Kotak Mahindra Bank, and from there they can activate their new zero balance savings account with KMB. In this post, we have added the quick process of opening a new bank account with Kotak 811 service and access to mobile and internet banking services.