Oriental Bank of Commerce offers a huge number of monetary facilities and administrations, for example, opening accounts, electronic financial administrations, protections, money the board, advances, charge cards, and so on. A record-holder may need to contact the Oriental Bank of Commerce cares and helps their clients. One can contact the client administration group through call, SMS, email, and so on. Check steps to OBC net banking login below.

The internet banking URL is www.obconline.co.in If you are utilizing Oriental Bank’s internet banking out of the blue and you have gotten both the client id and secret word, pursue the means given underneath for login successfully:

How to Register for OBC Internet Banking?

There is nothing much you have to do for completing your internet banking registration. You can quickly register for digital banking services by visiting the home branch. Furthermore, one can follow the steps we have given below.

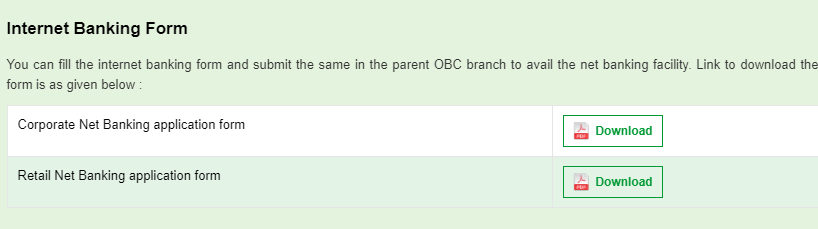

- First, one needs to visit the net banking website. You can visit the OBC portal from here.

- After that, click on the internet banking section.

- You will find the application form.

- Just download the PDF file and take a print out for the same.

- You now have to fill in the application form and attach the self-attested documents with it.

- You now have to visit the home branch and submit this application to one of the bank executives.

- The bank executive will process this application.

- You will get the login id and password at your postal address.

How to Login into OBC Internet Banking?

Most of the banks are combined. Therefore, OBC (Oriental Bank of Commerce) is now combined with Punjab national bank.

So, users from the OBC can access the internet banking portal by visiting the PNB website. Furthermore, one can follow the steps given below.

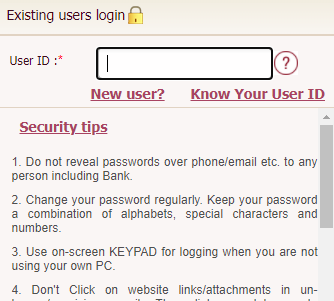

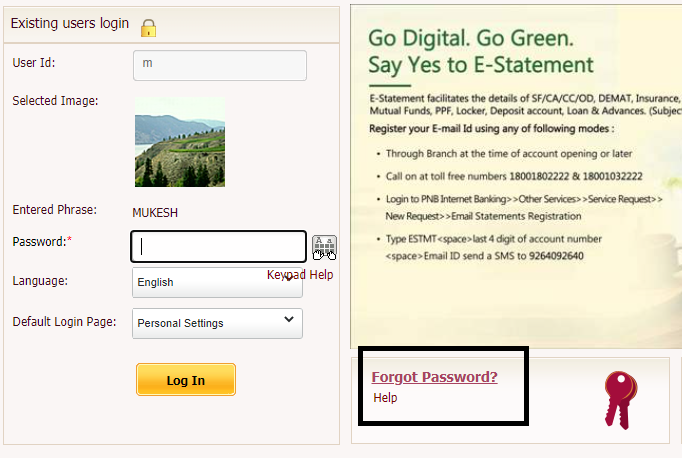

- First, visit the internet banking login page. You can visit by clicking here.

- After that, enter the user id and press the enter button.

- You now have to enter the password and click on the login button.

- Within a few seconds, you will get redirected to the net banking portal.

How to Reset OBC Internet Banking login password?

One can reset the login password by following the steps given below.

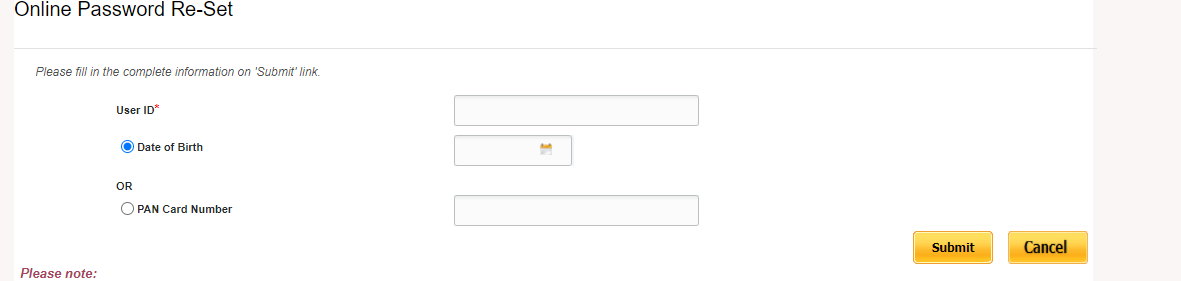

- First, visit the internet banking login page. You can visit by clicking here.

- After that, enter the user id and press the enter button.

- You now have to click on the “Forgot password” button.

- A form will appear on the screen.

- You now have to enter the user id, account number, and date of birth.

- Enter the further required details and click on the submit button.

- Complete the verification using the registered mobile number and debit card for resetting the login password.

- Once you get verified, you will get an option to set up the new login password.

Savings Account of Oriental Bank:

Oriental Bank of Commerce has a solid system of ATMs all over the country, which empowers clients to approach their cash whenever it might suit them. To suit the diverse budgetary needs of various clients, Oriental Bank of Commerce offers a scope of investment accounts. Clients can pick the sort of record that suits their needs the best.

To open a Savings Account with OBC, you can either download the record opening structure from the bank’s legitimate entry or go to the closest OBC branch to get the application structure. In the wake of topping off the structure appropriately, submit it to any part of your decision. It would be ideal if you recall that you need to outfit the structure with all the vital records like international ID size photos, ID evidence, and so forth.

This record takes into account those natives of India who satisfy each qualification criteria of opening a ledger, yet can’t agree to the budgetary weight of keeping up a base equalization in the record. This record gives assignment office to the record holders and they likewise get an ATM card for nothing. The holders of fundamental SB Account can’t benefit from the web banking office.

OBC is very prevalent among OBC clients, and the ATM issued through this kind of record doesn’t have the charges for restoration or issuance. Clients likewise get customized multi-city checkbooks free of expense and get a 25% rebate on storage rental charges.

Record holders appreciate a half concession on storage rental charges, and customized multi-city checkbooks free of expense. The ATM card issued with this sort of record doesn’t have any charges for recharging or issuance. On the off chance that the record holder can look after ABQ, the customer gets an individual mishap protection front of Rs.10 lakhs, free of expense.

Frequently asked questions

Is there any way to register for OBC internet banking online?

No, you need to visit the home branch for completing the OBC internet banking registration.

What are the charges for using OBC net banking?

This service is free of cost. You do not need to pay anything for using or activating OBC internet banking services.

How to Reset a password online?

You can reset the login password online with the help of a debit card and registered mobile number. Furthermore, one can check out the process we added above.

What is a user id?

A user-id is a unique number allocated separately to every individual or account holder. You cannot log in to the net banking portal without having the correct user id.

Who can avail of the internet banking services from the Oriental Bank of Commerce?

Who has an account with Oriental bank of commerce can avail of internet banking services.

Conclusion

Oriental Bank of Commerce is one of the largest commercial banks in India. Recently, this bank has been merged with Punjab National Bank to provide better services to the customers. However, this article is solely related to OBC net banking services. In this article, we have added all the information that one needs to know for activating OBC internet banking.