SBI Mobile Banking is an internet banking service that has been optimized for mobile browsers. One of the major benefits associated with the mobile banking facility is that you no longer need to visit the bank not just for bill payments but also for things like viewing the account balance and getting the mini statement. Everything from fund transfer, IMPS transfer, e-Flexi deposits to NPS contribution, can be handled from one place once you activate the banking facilities on your mobile.

The best part is that, just like the desktop version, the mobile version of SBI is free too, and, you will only have to incur the internet usage charges as levied by your telecom operator.

Benefits of SBI Mobile Banking

To be an instance, mobile banking services are the same as internet banking services. There is only one difference in using mobile banking services, and the difference is, one can use this service from anywhere using the smartphone.

However, I am adding up some benefits here.

- The customer can use this service from anywhere with the help of their smartphone.

- The customer can transfer the funds using SBI phone banking services.

- The customer can check the bank account balance and other account information using mobile banking.

- The customer can update the personal profile section.

- The customer can request the bank account statement, credit cards, and Cheque book using mobile banking.

- The customer can make bill payments using mobile banking.

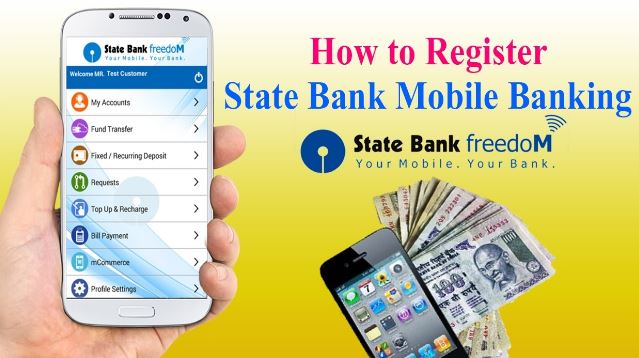

How to Register for SBI Mobile Banking?

Activating SBI phone banking, without visiting the home branch, consists of the following two processes:

1- Over the mobile handset

2- At the SBI ATM or Online SBI.

Mobile Handset:

You will have to send the SMS <MBSREG> to the number 9223440000 or 567676.

You will get the User ID and default MPIN via SMS. You can also get a link through another SMS that you can use for downloading and installing the application.

You can also download and install the application from Google Play or the Apple store. For those with a non-java mobile and GPRS connection, the mobile banking services can be used over Wireless Application Protocol (WAP). The services are available for all mobiles, both java and non-java based, that have GPRS or data connectivity.

You must like to read, How to Check SBI Credit Card Application Status Online for Free?

OnlineSBI & ATM:

You are at the final stage of the process of activation, and, you can complete the procedure either through SBI ATM or online SBI.

Through ATM:

- Swipe the Debit card and choose the option of ‘Mobile Registration’ and then go to ‘Mobile Banking.’

- You will find the option of ‘Registration’ under Mobile Banking.

- Here, enter the phone number and select ‘Yes.’ Select confirm when the number gets displayed on the ATM screen, and you will get the transaction slip that confirms the registration.

- The activation of your account will be confirmed via SMS. You can now enjoy all the services that come under SBI Mobile Banking.

Through Online SBI:

- Log on to OnlineSBI and select ‘State Bank Freedom’ from the ‘eServices’ option.

- Make sure that you change the MPIN before this step. (If you have not? Then, one can look into the process we have given below.)

- You will receive a message that validation of the handset is complete. Choose ‘Registration’ from the options you get on the top.

- You will get a list of accounts enabled for the online user. Select the account that you want to enable for Mobile Banking Services and submit. Keep in mind that this is your primary account for mobile banking. You can register just one account using OnlineSBI.

- If you want to register other current or saving bank accounts under one CIF, you will have to visit the home branch of that primary account or the accounts that you want to enable.

Changing the MPIN:

- For the ones using the service over-application

If you are using the services through the app, then after installing the app, log in with the User ID you received in the SMS. Keep in mind that the User ID is case sensitive.

You will get the list of terms and conditions, and you will have to accept that to move on to the process of changing your MPIN. Put the default MPIN in the space that ‘old MPIN’ and put in a new MPIN of 6 digits in the ‘new MPIN’ box. Click on change, and you will receive the confirmation about the change via SMS.

2. Changing the MPIN when using Wireless Application Protocol

The following are the steps to change the MPIN through Wireless Application Protocol:

- Open the browser and enter http://mobile.prepaidsbi.com/sbiwap/

- Enter the User ID and the default MPIN on the screen that comes up and log in.

- The WAP login ID that the next screen asks for will be delivered via SMS.

- Enter this ID on the screen and click on send.

- You will get the Main Menu of SBI Mobile Banking Service if you enter the details correctly.

- Select Settings from the Main Menu and choose ‘Change MPIN.’ Put the default MPIN in the space that ‘old MPIN’ and put in a new MPIN of 6 digits in the ‘new MPIN’ box. Submit it, and you will receive the confirmation about the change and validation via SMS.

After you successfully change the MPIN, you will receive another message that the validation from your handset is successful. You will have to complete the registration now at the ATM, online, or the branch.

How to Login into the State Bank of India Mobile Banking?

- You must have already downloaded the mobile banking application.

- Just open it on the smartphone.

- You now have to enter the user and m-pin on the required fields.

- Once entered, click on the login button.

- Within a few seconds, you will be at the mobile banking dashboard.

The Security Factor of Using SBI Mobile Banking:

SBI Mobile Banking is absolutely secure, and you will not need to worry about identity theft and other such issues while using these services. The following are the four crucial security features of SBI Mobile Banking.

- No personal information gets stored on your SIM card or mobile phone

- You can only use the application after properly authenticating your username and password

- 256 bit SSL encryption is used to protect your communications with the bank

- The session ends as soon as the mobile browser is closed

SBI Mobile Banking facilities are available 24/7, and even the users of the rural areas can avail of these services. It is highly cost-effective in the sense that you can use the services from anywhere without paying a visit to the branch. In fact, the bank even offers several benefits to the customers who opt for mobile banking facilities. So, go ahead and activate SBI phone banking today to avail all the benefits that come with it.

Frequently asked questions

What are the prime benefits of using the State Bank of India Mobile Banking services?

The prime benefit of using the State Bank of India Mobile Banking Service is, one can use this service 24/7 and from anywhere. Moreover, there are no charges for using this service.

Who can request this service?

It is available for all the SBI Bank account holders. The customer only needs to have the registered mobile number and account number with them to complete the registration process.

Furthermore, one can check out the registration guide to mobile banking that we have added above in this article.

Is it necessary to keep the MPin alphanumeric?

Yes, It is necessary to keep the MPin alphanumeric.

What is the number of characters required in SBI MPin?

Six are the number of characters required in SBI MPin. However, make sure that the number of characters is a combination of special and alphanumeric characters.

Will the service get deactivated if we stop using it for a longer time duration?

Yes, if the service is paused and does not get accessed till 6 months. Then, the service will automatically get deactivated.

Conclusion

Here we come at the end. In this article, we have added a definitive guide to complete SBI mobile banking registration. We already know the importance and benefits of using this service. However, not everyone is familiar with using mobile banking services. Therefore, we have decided to add complete steps for the people who are looking to activate mobile banking services online.

In case of any doubts or queries? One can always ask us in the comments section.