Ratnakar Bank Limited or RBL Bank offers an extensive range of credit cards which in turn offers plenty of benefits. Some of the benefits are membership privileges including cashback offers, reward schemes, and others. The credit card rewards are given on shopping, entertainment, fuel expense, and others. RBL Bank is among the oldest private banks. The services that offer include corporate, commercial, retail, agricultural, development along with the financial market. However, it offers 12 different credit cards to customers without checking their financial background. Different cards are designed that offer excellent advantages to customers. Check the RBL Credit Card Payment process below.

However, bill payment has become an easy affair with the introduction of both online and offline modes of payment. Irrespective of whether it is your electricity bill or credit card bill, you can be paid from the comfort of your home easily. You only need to know some simple steps that can help you complete the payment procedure easily.

Features of Online RBL Credit Card Payment:

It offers an easy method of bill payment irrespective of time and place.

- With help of this credit card, utility bills such as electricity, telephone, and mobile bills can be paid easily. In addition, insurance bills, make donations, or pay for magazine subscriptions.

- The bill payments enable making payments in a timely manner by registering the name of the biller. For a one-time payment, you can use the ‘Insta Pay’ option. In a single transaction, you are able to make multiple bill payments.

- Other than this, the registered billers can easily get to see the bill date and the amount due to it. In addition, alerts can be sent via SMS settings. You can also check for any new bill or status of bill payment.

How to apply for an RBL Bank Credit Card Online?

You can apply for an RBL bank credit card online. There is no need to visit the bank to complete the application process.

Furthermore, we have added the definitive guide for the online application below. Let’s have a look.

- First, you will have to visit the official website of RBL Bank. You can visit it by clicking here.

- Second, you need to click on the credit cards option.

- On the next screen, you need to select the credit card you need. (This depends upon the eligibility of the customer)

- Once selected, you now have to fill in the required information in the form.

- Once you are done filling in all the required information, you can now click on the submit button.

- That’s it. You will receive a call from one of the bank executives to complete the further process.

What are the Eligibility Criteria for Getting RBL Bank Credit Card?

- The minimum age requirement for the cardholders is 21 years. The maximum limit is 65 years.

- To get an RBL Bank credit card, the person should be an employed and salaried person as well.

Therefore, when applying for a credit card, you have to submit some documents to prove the above-said conditions. In addition, you have to submit address details, identity proof along with an income certificate. Along with this, you have to produce documents such as Aadhaar card, passport, voter’s ID, ration card along with other government-approved documents. You also have to produce a PAN card as identity proof. For income proof, you have to show the latest from 16.

How to Pay RBL Bank Credit Card Bill Payment Online?

For RBL Bank bill payment, both offline and online mode is available. Some of the steps to do the payment are given in the following part of the article.

Internet Banking: You can do the credit card bill payment will help of internet banking by using a bank account. Its detailed steps are given below.

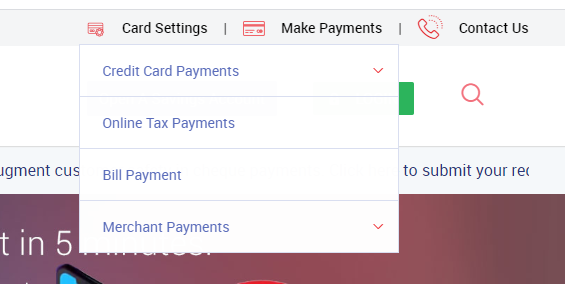

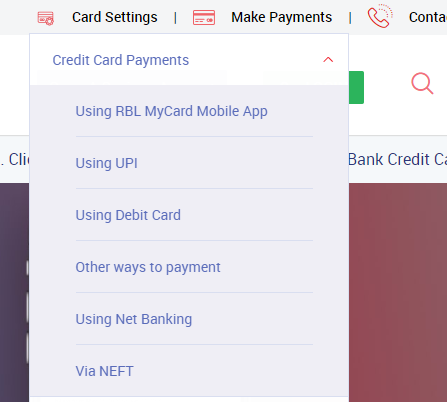

- First, you have to visit the official website of the bank and click on the ‘make payments’ link which is available on the right corner of the page.

- Following this, you have to click on the ‘credit card payment’ option.

- Now, you can choose from three gateways of payments such as Pau U, Razorpay, or Bill Desk.

- After selecting the payment mode, you have to fill in the required details and click on the ‘submit’ option.

- Following this, you have to choose the bank’s name from the given option.

- Now, you have to select a password and username in order to proceed with the payment option.

NEFT Method: For easy transfer of money, NEFT is a suitable option. RBL Bank gives this choice for easy payment of credit card bills. When you are making the payment via NEFT, you have to enter your credit card details along with your IFSC code.

RBL Mobile Application: The credit card bill payment can also be done through the RBL Bank application. Other than this, you can also manage your bank account with help of the application. You only have to download the application and install it and you are ready to make the bill payments online.

Quick Bill Payment: This can be done both with help of debit and credit cards. Customers from other banks can also avail of this benefit. For the complete process of this method of payment, 3 working days are required for the process.

Offline Methods are Given as Follows:

- Payment through cash – The credit card payment can also be done through cash which you have to pay by visiting the nearest bank branch.

- Payment by cheque or demand draft –The credit card payment can be done through demand draft or cheque mode when you have to drop the same to the nearest bank branch.

What are the Benefits of RBL Bank Credit Card?

It is said that the RBL Bank credit card is best suited for frequent travelers. With this, you are able to explore different parts of the world and get different benefits from using it. In addition, it offers plenty of reward points as well. The card offers an annual fee of rupees 2, 000 and it comes with some features which are given in the following part of the article.

- You can get 8, 000 reward points as a sign of a welcome gift after 30 days of card issuance.

- If you book a movie ticket via online movie applications, you can get one movie ticket free or rupees 200 off on the payment.

- You can get a complimentary airport lounge visit in a quarterly manner.

- For every rupees 100 spent on the credit card, you will get 2 reward points.

- You can get more reward points when you start using your credit card for making a bill payment, entertainment, dining, and fuel payment including international spending.

- Also, you can get 10, 000 reward points after spending rupees 2 lakh and 3.5 lakh in a year.

However, in this way, you are able to bag in reward points by increasing the use of RBL bank credit cards. The bill payment can be easily done via the online methods mentioned above. The methods make bill payment an easy affair.

Credit Card Customer Care – RBL Bank

The customer can call on the toll-free number +91 22 6232 7777 in case of any issues or queries related to the RBL credit card application.

This helpline is available 24/7. However, one needs to provide complete information before getting anything in revert.

Frequently asked questions

What should I do if my credit card gets stolen or lost?

You should immediately get in touch with the bank or call on the customer care number +91 22 6232 7777 to get it blocked. The customer care executive will first verify your identity and then get it blocked.

Can I use an RBL bank credit card to withdraw cash from the ATM’s?

Yes, you can use an RBL credit card to withdraw cash from the ATM’s. However, this is a chargeable service. So, avoid using it.

Can I use an RBL credit card internationally?

Yes, you can use your credit card internationally. However, you need to get the international transaction activated.

What is an add-on credit card?

Add-on credit cards are issued against the primary credit card. It is generally for the family members and its use. The add-on credit card can get most of the privileges of the primary cardholder.

RBL Bank allows up to 5 add-on credit cards to the customers.

How to know the status of your credit card application?

You can check the status of your credit card application online or by calling on the customer care number +91 22 6232 7777. You can also visit the bank for getting such details.

How to make credit card bill payments online?

You can make the credit card bill payment online with the help of internet banking or a wallet application. There are 100’s of application that supports online credit card bill payments.

In how many days the payment gets settled on the credit card?

Three days is the minimum time for the payment to get settled on the credit card. However, sometimes it does take a week as well.

Conclusion

Here we come at the end. This article is solely related to the RBL Bank credit card. In this article, we have added the definitive guide for making credit card bill payments online. Furthermore, we have even added the online application process.

You can comment it down if there is any issue or something is not understandable.